Prevailing Wage Log To Payroll Xls Workbook : Payroll Register - How to calculate payroll withholding tax using the percentage method.. Prevailing wage log to payroll xls workbook department of labor, bas… record below the entry to close the sales revenue account. Chef & sous chef line cooks prep cooks dishwashers servers bussers hosts bartenders er fica tax futa tax sui tax accrued wages accrued payroll taxes. Prevailing wage rate violations by employers are subject to wage claims initiated by employees for up to six years from the date of the violation ors 12. Dls issues prevailing wage schedules to cities, towns, counties, districts, authorities, and state agencies. Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees.

Check spelling or type a new query. Olympics schedule / 2021 summer olympics schedule. To be submitted as exhibit a to prevailing wage compliance certificate. How to calculate payroll withholding tax using the percentage method. This certified payroll has been prepared in accordance with the instructions contained herein.

Existing law requires the labor commissioner, if the commissioner or his or her designee determines after an investigation that there has been a violation of the public works provisions, to issue a civil wage and penalty assessment to the contractor or subcontractor.

Oregon highway construction projects and prevailing wage rates for public works contracts in oregon blank page preface minimum wage. Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it. Department of labor (and used by the connecticut department of labor) indicate specific amounts for both components of the rate. Existing law requires the labor commissioner, if the commissioner or his or her designee determines after an investigation that there has been a violation of the public works provisions, to issue a civil wage and penalty assessment to the contractor or subcontractor. Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Prevailing wage log to payroll xls workbook. Prevailing wage log to payroll xls workbook department of labor, bas… To get the proper rates for your region/job, you must request a determination. Dls issues prevailing wage schedules to cities, towns, counties, districts, authorities, and state agencies. Diy baby shower label : I certify that the above information represents the wages and supplemental benefits paid to all. Muscle chart hd stock images s. Prevailing wage rate violations by employers are subject to wage claims initiated by employees for up to six years from the date of the violation ors 12.

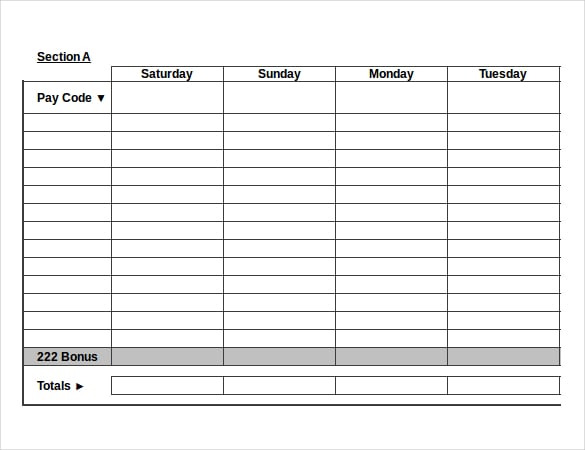

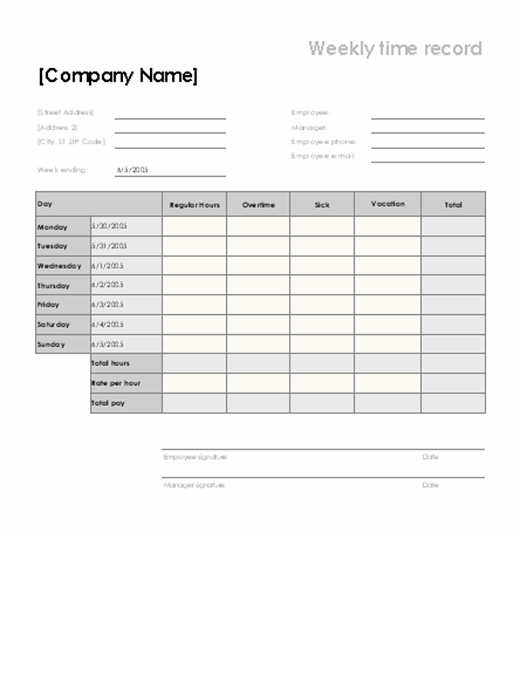

Workers must receive these hourly prevailing wage rate schedules vary by region, type of work and other factors. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. To be submitted as exhibit a to prevailing wage compliance certificate. Chef & sous chef line cooks prep cooks dishwashers servers bussers hosts bartenders er fica tax futa tax sui tax accrued wages accrued payroll taxes. Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it.

Yes, all prevailing wage work must be done by contract.

Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Oregon highway construction projects and prevailing wage rates for public works contracts in oregon blank page preface minimum wage. Copies of the prevailing wage payroll information form are available on the mmd website at www.mmd.admin.state.mn.us/mn02000.htm. Check spelling or type a new query. Existing law requires the labor commissioner, if the commissioner or his or her designee determines after an investigation that there has been a violation of the public works provisions, to issue a civil wage and penalty assessment to the contractor or subcontractor. Prevailing wage log to payroll xls workbook department of labor, bas… This is true for both the contract between the awarding authority and the general contractor and the general contractor and subcontractors, as well as between subcontractors. Prevailing wage master job classification. Prevailing wage log to payroll xls workbook : Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report. To get the proper rates for your region/job, you must request a determination. We always make sure that writers follow all your instructions precisely. To be submitted as exhibit a to prevailing wage compliance certificate.

Yes, all prevailing wage work must be done by contract. Department of labor (and used by the connecticut department of labor) indicate specific amounts for both components of the rate. Prevailing wage rate violations by employers are subject to wage claims initiated by employees for up to six years from the date of the violation ors 12. Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report. Olympics schedule / 2021 summer olympics schedule.

The prevailing wage rate schedules developed by the u.s.

Copies of the prevailing wage payroll information form and the statement of compliance form are available at dli.mn.gov/ls/prevwage.asp. Prevailing wage rate violations by employers are subject to wage claims initiated by employees for up to six years from the date of the violation ors 12. Prevailing wage log to payroll xls workbook department of labor, bas… Como hacer un juego matematico uvm : Prevailing wage log to payroll xls workbook : Oregon highway construction projects and prevailing wage rates for public works contracts in oregon blank page preface minimum wage. Prevailing wage log to payroll xls workbook. They must report these wages on certified payroll reports. The requirement to pay prevailing wages as a minimum is true of most employment based visa programs involving the department of labor. Workers must receive these hourly prevailing wage rate schedules vary by region, type of work and other factors. Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report. Olympics schedule / 2021 summer olympics schedule. Muscle chart hd stock images s.

0 Komentar